Should We Expect a Recession in Canada in 2023?

In 2020, Canada entered what was called “the shortest and deepest recession since the Great Depression” according to an August 2021 report by the C.D. Howe Institute’s Business Cycle Council. The economic consequences hit hard and swiftly, evaporating 17.7 percent of Canada’s GDP between February and April of that year. Although the economy started mending by May, the damage was done—3.4 million Canadians had already lost their jobs.

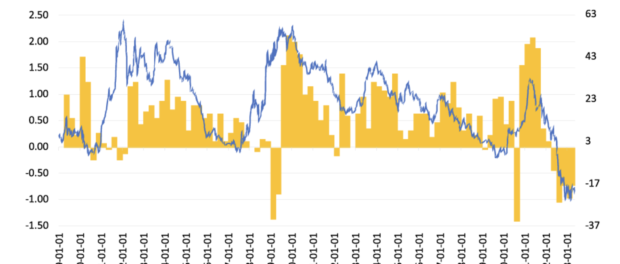

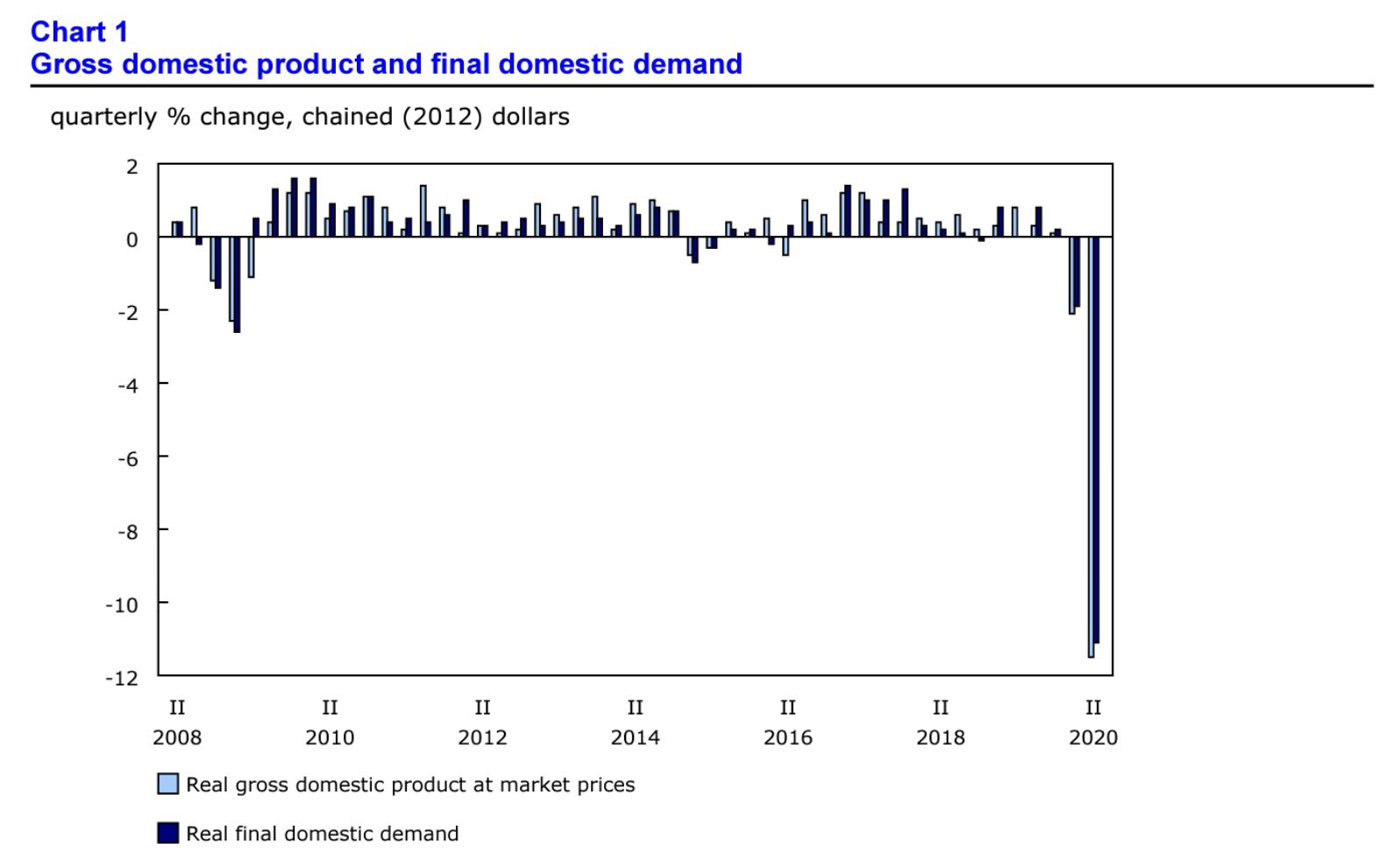

As seen below (Chart 1), it took six months of economic contraction until the federal employment rate bounced back to within 10 percent of pre-recession levels.

Source: StatsCan

Job loss, runaway inflation, lower spending, and lower purchasing power are all effects of recessions. When the next Canadian recession arrives, it’s important that you are well-prepared in order to protect your financial well-being and ensure that you’re protected from the negative consequences of recessionary economies.

Below, we’ll discuss Canada’s history of recessions—including their causes and effects—and touch on whether another recession is on the horizon in 2023 or 2024.

What Causes Recessions in Canada?

Recessions in Canada, like in any country, can be caused by a variety of factors and can have both domestic and global origins. Here are some key factors that can contribute to recessions in Canada:

1. Economic Shocks

External economic shocks, such as global financial crises or recessions in major trading partners, can significantly impact Canada’s economy. For instance, the 2008 global financial crisis originated in the United States and had far-reaching effects on the Canadian economy, leading to a recession.

2. Business Cycle

Economic expansions and contractions are a normal part of the business cycle. Periods of prolonged economic growth can lead to overheating, which can then trigger a downturn. Factors like excessive borrowing, speculative bubbles in asset markets, or unsustainable levels of consumer or corporate debt can contribute to economic imbalances that eventually result in a recession.

3. Changes in Interest Rates

Monetary policy decisions by the Bank of Canada, which affect interest rates, can influence the business cycle and economic activity. When interest rates rise, borrowing becomes more expensive, which can dampen consumer spending and business investment. Tightening monetary policy to curb inflation can sometimes contribute to an economic slowdownAs of July 2023, the Bank of Canada’s overnight rate is 4.75%—an increase of a quarter percentage point since April. This constituted the eighth interest rate hike in Canada over a 12-month period, having risen from just 1.0% in April 2022.

In 2024, it is broadly expected that the Bank of Canada will start to cut interest rates in order to stimulate economic activity and bring borrowing costs down from their current 22-year high.

4. Housing Market Instability

The Canadian housing market plays a significant role in the economy. Rapid increases in housing prices followed by a sharp decline can have ripple effects on consumer spending, household wealth, and banking stability. A housing market correction or a burst of a housing bubble can lead to a recessionary environment.

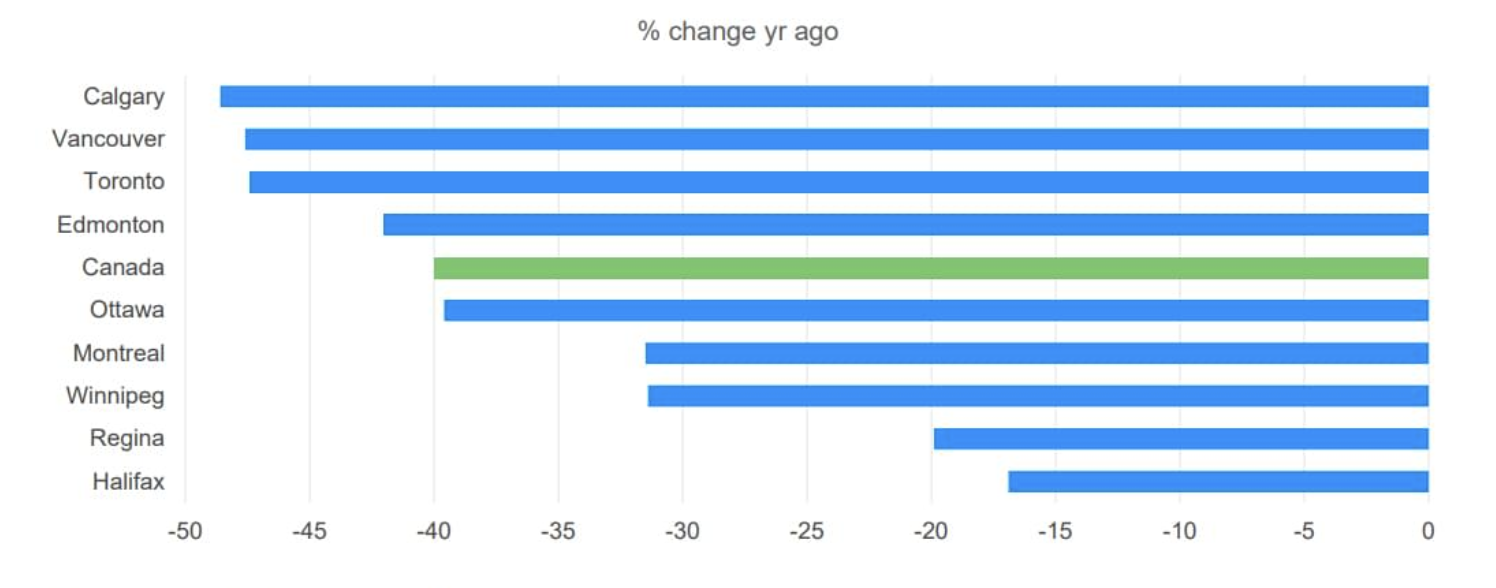

In Canada, the ongoing housing affordability crisis has caused a host of socioeconomic problems for Canadians. At the start of 2022, 5-year mortgage rates spiked 5.8%—the highest since the 2008 recession. This caused the Canadian homeownership cost ratio to rise to its highest levels since the 1980s and for existing-home sales to drop 40% from 2021.

Existing-home sales activity in major Canadian metros (Source: Moody’s Analytics)

5. Fiscal Policy and Government Spending

Government policies and spending decisions can impact the overall economy. A sudden reduction in government spending or austerity measures can have a contractionary effect on the economy, potentially leading to a recession. Conversely, fiscal stimulus measures, such as increased government spending or tax cuts, can help mitigate the impact of a downturn or stimulate economic growth.

6. External Trade and Commodity Prices

Canada is a resource-rich country heavily reliant on international trade. Changes in global demand for commodities, fluctuations in commodity prices (such as rising oil prices, precious metals prices, or agricultural products), or trade disputes can impact Canada’s export-oriented industries, leading to a slowdown in economic growth or a recession.

It’s important to note that recessions are complex phenomena influenced by multiple interconnected factors. Their causes can vary from one recession to another, and what happens in a recession also varies by locality.

The occurrence of a recession in any country, including Canada, is influenced by a combination of economic indicators, such as GDP growth, employment rates, inflation, interest rates, consumer spending, and business investment. These factors can vary over time and are subject to change based on various economic and political developments.

(Note: Want to diversify your portfolio with assets that have historically outperformed the stock market during recessions? Consider investing in gold in your RRSP or TFSA.)

The 2020 Canadian Recession: Impact, Causes, and Aftermath

The 2020 recession in Canada, like in many countries worldwide, was primarily caused by the global COVID-19 pandemic and the subsequent measures taken to contain its spread. Here’s an overview of key aspects related to the 2020 recession in Canada:

1. Impact of the COVID-19 Pandemic

The pandemic led to widespread lockdowns, travel restrictions, and social distancing measures, which had a severe impact on economic activity. Industries such as hospitality, retail, tourism, and entertainment were particularly affected as businesses were forced to close or operate with limited capacity. The sudden halt in economic activity caused a significant contraction in the Canadian economy.

2. GDP Contraction

Canada’s gross domestic product (GDP) experienced a sharp decline during the recession. In the second quarter of 2020, Canada’s real GDP contracted by a record-breaking 11.5%, the steepest quarterly drop on record. This decline was mainly due to reduced consumer spending, diminished business investment, and disrupted global trade.

Source: StatsCan

The chart above demonstrates the precipitous real GDP drop seen in the second quarter of 2020 during Canada’s most recent recession.

3. Employment and Unemployment

The recession resulted in a significant rise in unemployment rates across the country. Many businesses faced closures or downsizing, leading to job losses. The unemployment rate in Canada reached a peak of 13.7% in May 2020, the highest level since record-keeping began. Government support programs, such as the Canada Emergency Response Benefit (CERB), were implemented to provide temporary financial assistance to affected individuals.

4. Fiscal and Monetary Responses

The Canadian government implemented various fiscal measures to support individuals and businesses during the recession. These included wage subsidies, business loans, and direct payments to individuals. The Bank of Canada also took action by lowering interest rates to near-zero levels and implementing quantitative easing programs to provide liquidity to the financial system and support borrowing.

5. Uneven Sectoral Impact

The recession’s impact was not uniform across all sectors of the economy. Some sectors, such as healthcare, e-commerce, and technology, experienced growth or fared relatively well due to increased demand or the ability to adapt to remote work. On the other hand, sectors like travel, hospitality, and energy faced significant challenges due to restrictions and reduced demand.

6. Gradual Recovery

Following the initial shock of the recession, Canada began to experience a gradual economic recovery as restrictions were eased and vaccination efforts progressed. Government support programs played a crucial role in stabilizing the economy and supporting businesses and individuals. However, the pace of recovery varied across regions and sectors, and some long-lasting effects of the recession, such as scarring in the labor market, persisted.

The 2020 recession in Canada was unique due to its association with the global pandemic. The response to the recession involved a combination of public health measures, fiscal policy interventions, and monetary policy actions. Economic conditions and recovery efforts have continued to evolve since 2020, and ongoing monitoring is required to assess the current state of the Canadian economy.

Circumstantial Evidence and Analysis

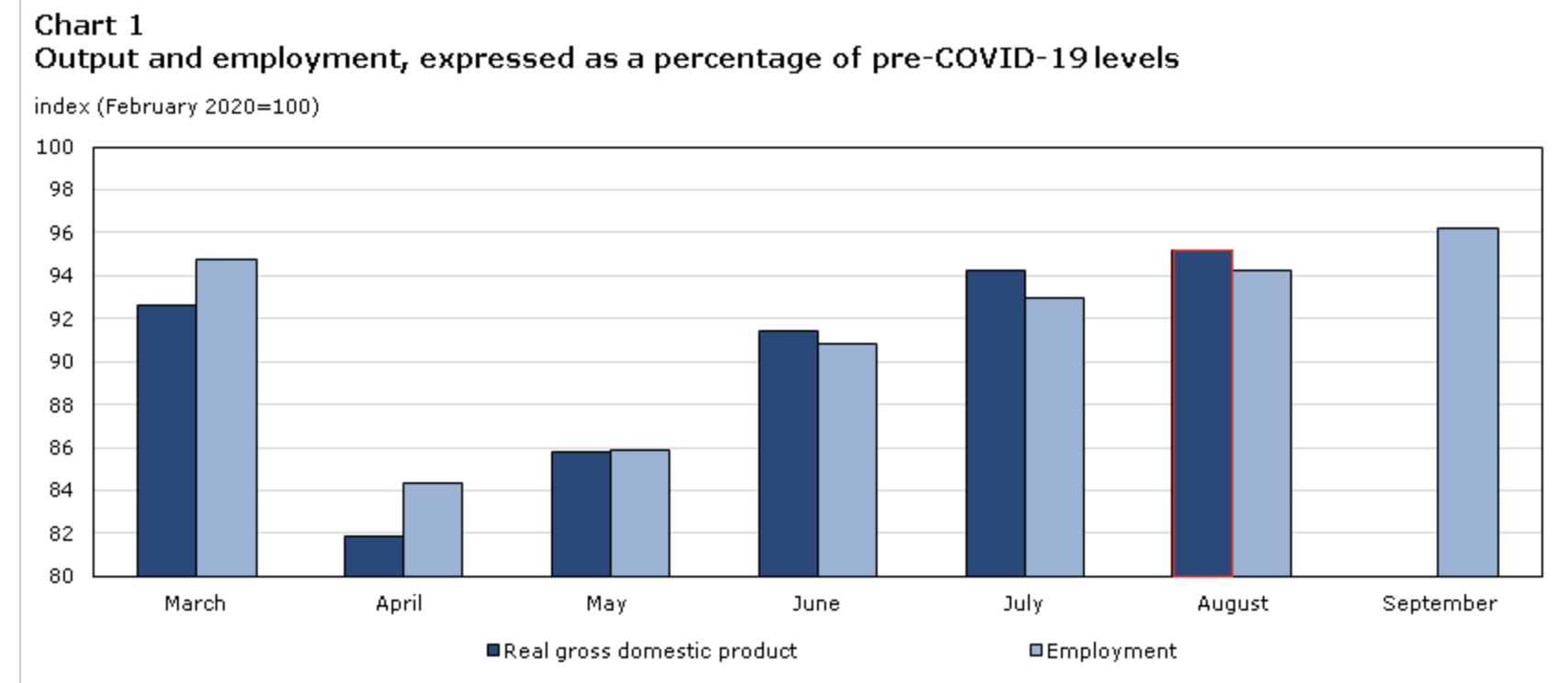

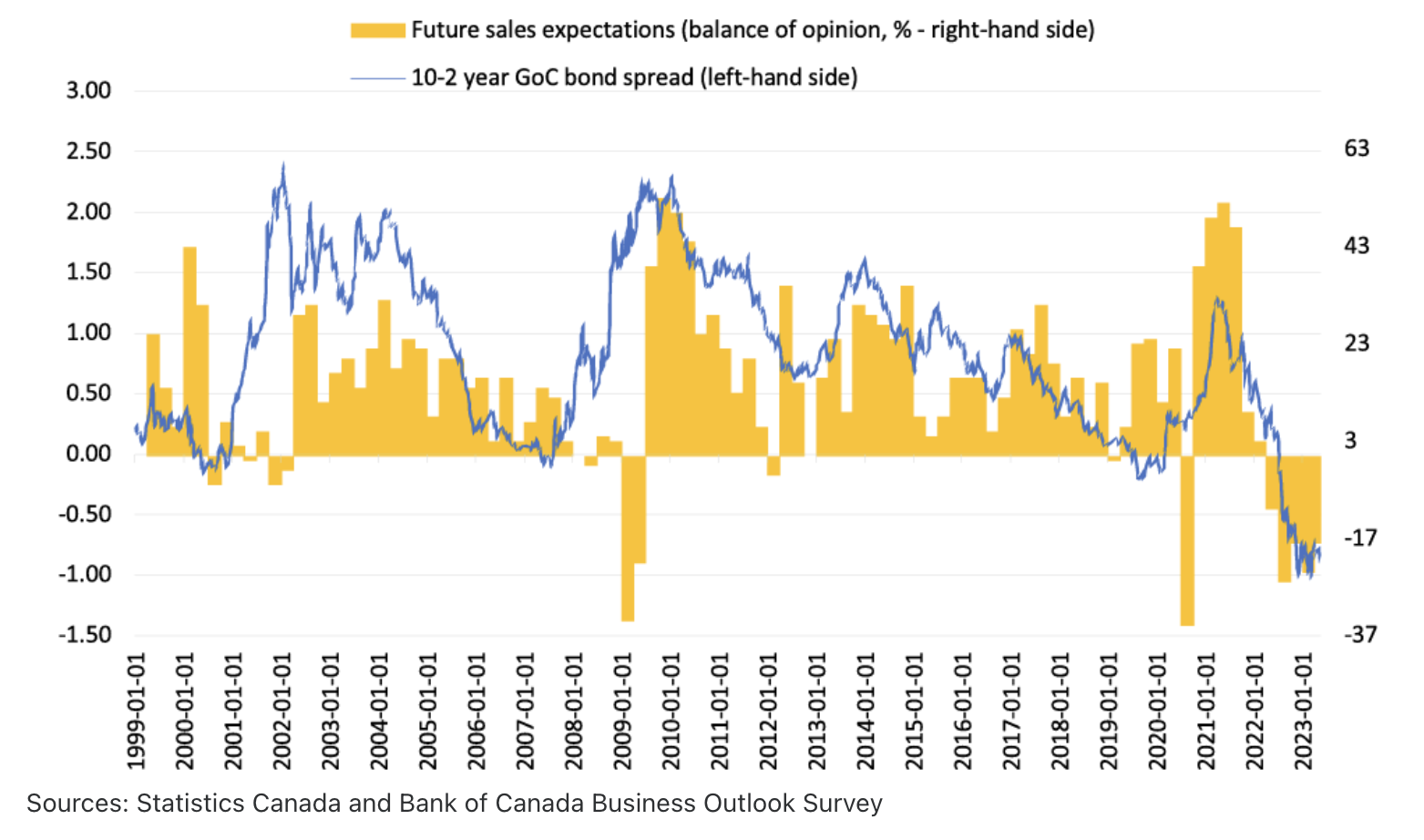

The Canada 10-year versus 2-year bond spread is -129.9 basis points, with long-term versus short-term maturities being inverted. The yield curve first inverted in August 2022 and has only continued to slope downward since.

As indicated by the chart below, the inversion of the 10-year yield curve coincided with a stark dip in Canadian businesses’ future sales expectations. When the yield curve inverted, the majority of Canadian business owners reported pessimistic outlooks on future sales.

Source: FCC-FAC

Historically, an inverted yield curve has been considered a quantitative indicator of a looming recession or of systemic weakness in an economy. For instance, every recession in the United States since 1960 has been preceded by a yield curve inversion. Importantly, however, not every yield curve inversion has been followed by a recession.

Sometimes the best indicator of recessionary activity in Canada is to ask local businesses if they have observed any changes in consumer behavior. For example, Jack Romano, the general manager of John The Plumber, an Ottawa-based plumbing service, told me that, in mid-2023, his quote requests dropped considerably compared to the prior year.

“Last year at this time, I had customers booked into fall by now, awaiting their renovations. This year, I can often squeeze people in the same weeks,” said Mr. Romano. “It seems that people are becoming far tighter with their money […] I have no doubt that mom and pop shops are really struggling, and I wouldn’t be surprised if there are countless contractors sitting at home waiting for their phones to ring.”

According to Romano, converted quotes accounted for 30.14% of his sales in May 2023, down from 39.5% in May of the previous year. He noticed a similar outcome in June as well.

Although these data are no doubt anecdotal, they suggest that there could be a winding down of consumer confidence and spending at the microeconomic level in certain parts of Canada. A lack of consumer confidence is a strong indicator of recessionary market activity.

However, retail spending remains resilient in Canada. In fact, retail sales volume saw a 5.7% annualized increase in Q1 2023—an outcome described as “surprising” by Royal Bank of Canada assistant chief economist Nathan Janzen.

Will Continued Interest Rate Hikes Cause a Recession in 2023?

As the Canadian Union of Public Employees (CUPE) pointed out in a March 2023 statement, central bank rate hikes in response to high inflation “almost always causes a recession”. Nonetheless, real GDP growth of 3.1% (annualized) was recorded in the first quarter of 2023 despite consistent interest rate hikes throughout Q3 and Q4 2022.

Therefore, negative GDP growth would have to occur in two consecutive quarters in Canada between Q2 and Q4 2023 for a recession to take place this year.

According to Bloomberg BNN, the likelihood of such an outcome taking place is about 60% as of June 2023. In particular, they estimate that softness in the Canadian economy will take hold in Q4 of 2023 and will continue into the first half of 2024. The report’s author cites “hefty interest rate hikes” as the likely primary driver of a “mild recession” later in the year.

It’s important to note that nobody has the means to predict the future. While a broad consensus of economists seems to agree that a mild recession is likely or probable in late 2023 and early 2024, there is a non-trivial chance that the Canadian economy will avoid one altogether. Canadian consumers may continue to demonstrate resiliency and help their economy achieve a soft landing in the aftermath of the Bank of Canada’s hawkish interest rate campaign.

Final Verdict: Recession Likely Within the Next 18 Months

While it is impossible to make economic forecasts with certainty, circumstantial evidence and expert analyses from third parties suggest that a recession in Canada is likely in the short to medium term. As BNN Bloomberg reports, the likelihood of a recession in Canada in 2023 and early 2024 is about 60% as of June 2023.

However, as the Conference Board of Canada forecasted earlier this year, any recession that occurs in 2023 is likely to be a brief and mild one. The underlying fundamentals of the Canadian economy remain resilient, and a strong labor market and industrial sales record have buoyed Ottawa’s financial health throughout the year so far.

Nonetheless, investors may want to consider preparing themselves for a potential recession that could result in job loss or salary deductions. Diversifying with a range of non-correlated assets and volatility hedges—such as gold and precious metals in your RRSP or TFSA—can help you manage risk in your portfolio and preserve more of your wealth during market downturns.

Will Your Retirement Weather the Next Financial Crisis?

Gold has been used as an inflation hedge and a way to preserve wealth for millennia. We partnered with Silver Gold Bull, Canada's top-rated gold company (with over 280,000 five-star reviews), to offer Canadians a low-cost and tax-advantaged way to buy gold and silver through an RRSP/TFSA or another retirement plan.

Request More Info

Website: www.SilverGoldBull.ca

Speak to an Expert: (877) 707-4707

Copyright 2023 Gold RRSP - Helping Canadians invest in physical bullion for retirement