Lithium Stocks Canada: 6 Top Performing Stocks for 2023?

Before we go through a list of lithium stocks Canada, let’s get to know a little more about this highly demanded metal. Lithium has seen a surge in value over the past three years mainly due to the exponential increase in electric vehicle battery production.

The rare metal is also used for cell phone batteries, pharmaceuticals, and heat-resistant glass. However, it is by far the massive increase in electric vehicle batteries that are boosting demand. The main concentrations of lithium are in Chile and Australia, with China and Argentina coming third and fourth.

According to the US Geological Survey of January 2022, there were 22 million metric tons of lithium global reserves. And 89 million metric tons of resources worldwide. The survey also details how Lithium metal and its composites have been rising in price.

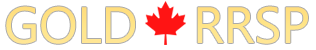

And you can see from the chart below how strong that trend has been. Since May 2021, lithium futures quoted on the COMEX exchange have gained 459% in price.

Source: TradingView

However, you cannot hold lithium metal products due to its dangerous compounds. To get exposure to lithium returns the best way is by investing in lithium stocks. That is companies that are involved in the extraction and production of Lithium.

Also, to create a diversified portfolio it is always wise to add other assets such as precious metals. Gold in particular is known to have the capability of reducing the overall risk of a portfolio and act as a last-resort store of value.

Lithium Stocks Canada Ranking

To create our list of the best lithium stocks in Canada, we looked at performance year-to-date and a couple of other fundamental data, detailed below.

Market Capitalization: Total dollar value of the share quoted on the exchange. This is an indicator of the depth of the market and liquidity.

Average Trading Volume: This is an important number as you want to know that you can easily enter and exit your investment.

Nevada Sunrise Gold (TSXV: NEV)

- Market Capitalization: $27.9 Million

- Average Trading Volume: 211,761 shares

- YTD Return: 346%

Nevada Sunrise Gold Corp. is the sole owner of two lithium fields in Nevada. The Gemini and Jackson Wash assets are both located in the Lida Valley basin. The company also owns 100 percent of the Coronado VMS project, 20 percent of the Kinsley Mountain gold project, and 15 percent of both a copper and a cobalt project.

NEV began the exploration drilling program at the Gemini project in March 2022. In April 2022, the company released data on the drilling results. Showing that the mineralization produced 950 parts per million of lithium. The stock price started to rise and jumped higher when the company announced further drilling results showed mineralization at 1,101 parts per million.

After the news of improved mineralization results, the stock price jumped from $0.075 to $0.135 in one day. We can see from the chart below how the stock price has continued to rally albeit with some large swings. However, volatility is something to expect in a small-cap stock.

Source: TradingView

In July, the company secured permits for phase II drilling and received permission to increase the number of boreholes to twelve. The company will start the second phase of exploration in late September 2022.

In June 2022, the company also raised $1.5 million in a private placement, which will secure its cash needs for the coming years. The private placement was issued through the sale of 7.5 million shares. The shares have a holding period of four months. So, until October 30, 2022, these shares can’t be traded.

The shares of this lithium stock started in 2022 at $0.065 and have continued to rise throughout the year. The stock price reached a year-to-date high at the end of August when it briefly touched $0.40. The stock is currently trading at $0.29 for a 346 percent return year-to-date.

Sigma Lithium Corporation (TSXV: SGML)

- Market Capitalization: $2.6 billion

- Average Trading Volume: 551,341 shares

- YTD Return: 185%

Sigma Lithium Corporation is an interesting security in our opinion, among many factors one that stands out is that Bank of America named it in its list of Top 50 Stocks for Scarcity Themes. The scarcity themes cover a wide range of sectors. So, to be named in a list of the top 50 seems foretelling.

This company is headquartered in Brazil and is the company with the largest market cap on our list. Sigma owns and operates the Grota do Cirilo project in Minas Gerais, Brazil. The project is at an advanced stage and is expected to begin operations by the year-end of 2022.

Forecasts for the production rate place output of lithium at 270 thousand metric tons per year. The company predicts the net present value of the project at $5.1 billion and a free cash flow of $595 million during the 13 years of production.

Source: TradingView

Sigma shares opened 2022 trading at the price of $13.00, the price action of the share remained range bound $15.10 and $10.70 until March 21, 2022. Then the current bull market took over and the price rallied to $18.76 by March 24, 2022.

Further consolidation took place as the stock price rallied higher to $24.55. But in August a new rally began, sending the price of Sigma shares to a year-to-date high of $38.84. The stock price has begun to retreat slightly since that high. However, this lithium stock is still up 185 percent year-to-date.

Jordan Resources Inc. (TSXV: JOR)

- Market Capitalization: $16.3 million

- Average Trading Volume: 377,832

- YTD Return: 60%

Jordan Resources was founded in 1970 and is headquartered in Toronto, Canada. The company is an exploration stage operation that engages in the acquisition and development of lithium, molybdenum, and other minerals in Canada.

JOR’s current projects include the Vallee – lithium, the Baillarge – lithium-molybdenum, and the Preissac-LaCorne lithium projects. According to the company management, they have the most extensive lithium exploration portfolio in Quebec.

On May 24, 2022, the company published its winter drilling campaign results. Investors reacted positively and the stock price rallied from an open at $0.05 to reach a temporary high of $$0.095. Price action remained subdued although trending higher, by September 2, 2020, the stock price reached a year-to-date high of $0.10.

Source: TradingView

In July, the company released more updates on its drilling results which fueled the stock’s rise to the high of 2022. On a year-to-date basis, Jordan Resources’ stock price has returned 60 percent at the time of writing.

Lithium Energy Exploration Inc. (TSXV: LEXI)

- Market Capitalization: $17 million

- Average Trading Volume: 27,174 shares

- YTD Return: 30%

Lithium Energi Exploration was founded in 1998 and is also headquartered in Toronto, Canada. They operate in acquisitions, exploration, and evaluation of lithium properties. The company’s main lithium projects are in South America, in the so-called Lithium Triangle.

LEXI has a project in the Argentina area of the Lithium Triangle with 72 thousand hectares of lithium brine. In January 2022, the company announced that the joint venture operations with its partner Global Oil Management Group were accelerating.

On March 24, 2022, the company communicated that together with its operations in the Lithium Triangle they were to start operations on a new project. The company is set to start drilling operations in the Antofalla basin in the coming months.

Source: TradingView

When the company released the news about the new drilling operation in the Antofalla basin, the stock price jumped from $0.195 to briefly reach a year-to-date high of $0.38 on April 8, 2022. From that point, the stock price has drifted sideways but is still up on a YTD basis by 30 percent.

Frontier lithium (TSXV: FL)

- Market Capitalization: $505 million

- Average Trading Volume: 251 thousand shares

- YTD: 12.5%

Frontier Lithium states its objective is to be a manufacturer of battery-quality lithium for electric vehicles and lithium-ion batteries. The company is currently developing the PAK project, located in Ontario’s Electric Avenue.

The project is one of North America’s largest high-tonnage and high-grade hard rock lithium resources. On March 1, 2022, the company announced an update on the resources at the PAK’s Spark deposit. Indicated resources were increased to 14 metric tons with an average of 1.4 percent of lithium oxide.

A month later, Frontier hired Tony Zheng as the new CFO, bringing 11 years of experience in finance, risk management, and corporate strategy. At the beginning of May, Frontier published its exploration plans for 2022. Citing the continued development of the Spark deposit.

Source: TradingView

This stock’s price rallied from its opening of $2.08 at the start of 2022 to reach a YTD high of $$3.89 on May 4, a few days after announcing the exploration plans for 2022. Frontier Lithium stock price has only managed to gain 12.5 percent year-to-date. However, the company’s drillings show promise in terms of future extraction rates, and we feel it deserves to be on the list.

Wrapping Up

Investing in lithium stocks may present an opportunity to gain exposure to the returns of a commodity that is in ever-increasing use. The boost in demand is coming from electric vehicle battery production. However, lithium is also widely used in many household products such as cell phone batteries.

Given that electric vehicle manufacturers seem to be stepping up their production to meet various countries’ new legislations that will prohibit gasoline vehicles in the coming years, it seems likely that demand for lithium will continue. And with that high demand, prices will likely continue rising.

If you are going to invest in lithium stocks you may want to take advantage of a tax-enhanced environment by investing through a registered retirement plan.

However, if you are looking for a way to protect your portfolio from a possible stock market rout, we believe your best investment would be in precious metals. You can read our reviews on the best RRSP brokerages here.

Will Your Retirement Weather the Next Financial Crisis?

Gold has been used as an inflation hedge and a way to preserve wealth for millennia. We partnered with Silver Gold Bull, Canada's top-rated gold company (with over 280,000 five-star reviews), to offer Canadians a low-cost and tax-advantaged way to buy gold and silver through an RRSP/TFSA or another retirement plan.

Request More Info

Website: www.SilverGoldBull.ca

Speak to an Expert: (877) 707-4707

Copyright 2023 Gold RRSP - Helping Canadians invest in physical bullion for retirement