How Much Gold do You Need to Own?

There are many factors to consider when deciding how much gold to include in your retirement portfolio. It depends on your age, your tolerance for risk, what other investments you own, your confidence in the economy and the methods you choose to gain exposure to the precious metal. Buy gold to mitigate risk, not because you expect it to appreciate and get rich overnight. Gold should be viewed as “an insurance policy” against all your other investments.

The price of gold is very hard to predict because it is driven by psychological factors. There is no way to know if it is undervalued or overvalued; it is only worth what someone else is willing to pay.

Play it Safe in Your Retirement Accounts

Remember that your RRSP should include mostly safe, long-term investments. Avoid highly speculative investments in RRSP or TFSA accounts because there are no tax breaks for capital losses. You should speak to your financial advisor and do your due diligence on any investment you add to your portfolio.

Pick a strategy and stick with it through changing market conditions. This means you will have to periodically rebalance your portfolio as asset prices move. At least an annual rebalance of your portfolio will help keep it in line with your investment strategy. Kevin O’Leary, famous Canadian investor from the CBC’s Dragons’ Den and ABC’s Shark Tank, says he sticks to 5% gold and rebalances his portfolio every year to make sure he is always at 5% regardless of market conditions.

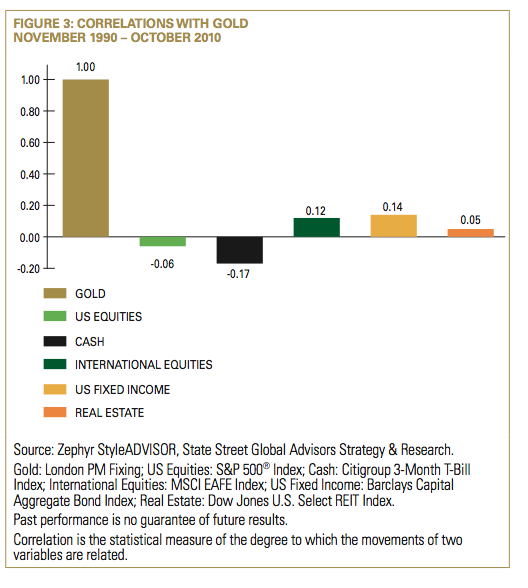

The more diverse your investments, the less risk you have. This is a fundamental rule of portfolio theory; don’t put all your eggs in one basket. An allocation of 60% stocks and 40% bonds is often recommended because stocks and bonds tend to move in opposite directions and you hedge your losses. It is also common to move out of stocks and into bonds as you age to reduce risk. Conveniently, gold does not correlate with stocks or bonds; it is a very unique investment tool in this respect (see the chart below). Adding gold to a traditional portfolio of stocks, bonds and even real estate may reduce the overall risk. However, deciding how much gold is right for you is not simple.

Conservative, Moderate or Agressive

Many investment advisors recommend maintaing a conservative 2-5% position in gold to hedge against market fluctuations and inflation. Kevin O’Leary, who manages a $1.5 billion mutual fund always maintains a 5% position in gold. Aside from gold, he sticks to investments that pay dividends but he always owns “gold as a stabilizer.” He sells when the price appreciates and his position grows beyond 5% and adds to it when the price declines and his position falls below 5%. This has been his strategy for decades.

A more moderate allocation of 5-10% makes sense if you expect an economic downturn in the near future. Recently, billionaire investors George Soros and John Paulson increased their gold holdings because they expect inflation to heat up over the next couple of years. Those who question central bankers’ decisions and ability to control inflation through monetary and fiscal policy might consider maintaining a position above 5%. Paulson currently maintains around 6% of his portfolio in the gold backed ETF (GLD). It is his fourth largest holding and he is also long several mining companies.

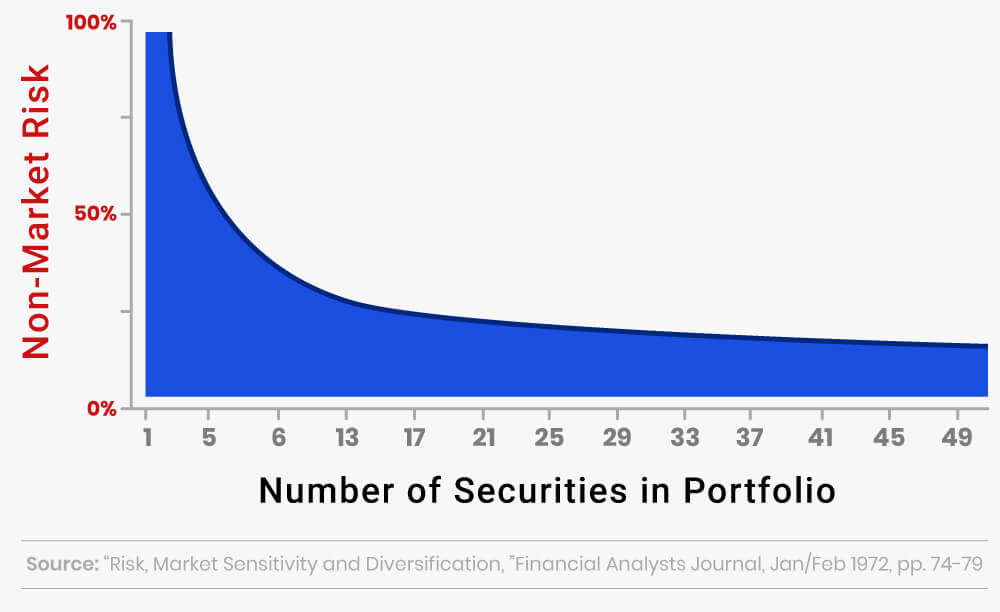

Those with little to no faith in the economy might even consider allocating 10-15% of their portfolio to gold. However, if you foresee a large scale economic collapse and do not want your portfolio tied to the dollar, don’t put it all in one basket – choose at least 10-15 baskets. Consider diversifying across different commodities, precious metals, commodity-linked ETFs, or stock in commodity producers. The graph below is well know in portfolio theory. It shows the reduction in risk from each additional stock, or asset in your account. After about 30 different investments, the reduction in risk is very close to zero. Putting more than 10% of your money into a single asset is generally considered unwise and risky.

Other Factors To Consider

Generally, as you get older your retirement portfolio should become less and less risky. A basic rule of thumb is to subtract your age from 100 to find the percentage of stocks you should own. So for instance, if you are 40 years old, consider keeping 60% of your RRSP in stocks. However, if you do not want to sell your equities as you age, add more gold. Gold almost always has a negative correlation with stocks.

If you are young and can tolerate some risk and ride out some volatility in the market, gold bullion or gold-backed ETFs may not be for you. Consider putting some of your stock allocation into gold mining companies or into a gold mining index fund. Alternatively, consider buying a platinum or palladium fund. These investments can be volatile but have potential upside in both bull and bear markets. Remember to keep highly speculative investments out of your RRSP, so preferably stick with ETFs and large-cap companies over small exploration and development companies.

Over the long run, stocks historically have a higher return than other investment options. In the short run, they can be very volatile. Your mix of stocks should be diversified across industries and countries. The more risk or market turmoil you are exposed to through your equity investments, the more gold you might want to hold to mitigate this risk. During periods of global turbulence, the correlation between equities (even different sectors and different countries) increases. This means that regardless of the diversity of stocks in your portfolio, when markets are shaken by unexpected political or economic news, all stocks tend to fall together and this is when the demand for gold skyrockets. Gold stock index funds can add an element of diversification to your equity holdings that investments in other sectors cannot.

Another theory that is used to determine how much gold to hold, divides investments in gold (and silver) into two categories, investment positions and core positions. Investment positions are taken by those who strategically allocate a percentage of their investments to gold to mitigate risk or because they expect the price to appreciate. A core position in gold is held as insurance against a worst-case scenario situation. This is in line with the adage, “always keep enough gold on hand to bribe the border guards.” In this case, you would not decide on a percentage allocation to invest in gold, you would determine the total amount you expect would be needed to get through a dire economic collapse or a situation of run-away inflation.

How much gold you choose to own is very personal, there is no formula that will give you an answer. Gold is a unique investment tool because it has very low systematic risk and very high unsystematic risk, meaning it does not correlate with most investments and it stores value through the worst of times, when the system falters. Gold mining stocks have more systematic risk as do other metals with more productive values. With this understanding, consider all the factors discussed above to determine how much gold you are comfortable holding and how you want to invest in the precious metal.

Remember that none of this content should be viewed as financial advice. Always speak to your financial advisor before making any investment decision, and do your due diligence before buying into any new type of investment. Lastly, remember that every type investment carries a certain level of risk, and that past results cannot always be indicative of future returns.

Will Your Retirement Weather the Next Financial Crisis?

Gold has been used as an inflation hedge and a way to preserve wealth for millennia. We partnered with Silver Gold Bull, Canada's top-rated gold company (with over 280,000 five-star reviews), to offer Canadians a low-cost and tax-advantaged way to buy gold and silver through an RRSP/TFSA or another retirement plan.

Request More Info

Website: www.SilverGoldBull.ca

Speak to an Expert: (877) 707-4707

Leave a comment