Preserving Your Wealth With Talk of Recession in Canada

According to GDP growth numbers from Statistics Canada, the economy was technically in a recession for the first half of 2015. While growth numbers are often revised and other indicators are more optimistic, talk of recession in the headlines inevitably sends shockwaves of fear through the markets. Clearly, the economy has been hard hit by low oil prices. Below $40/barrel, many Canadian producers close up shop and a significant number of jobs have been lost as a result. Falling global demand for commodities in general is hard on Canada. Central bank Governor Poloz noted recently that Canada is the only G-7 nation that is a net exporter of commodities. This means the slowdown in global manufacturing will be especially challenging and Canadian investors should be looking for safe havens outside of the country.

Cheap Loonies and Oil may be Around for a While

The catalyst of the current downturn was a drastic and continuing decline in the price of oil. Slowing growth in emerging markets, particularly in China, has been reducing global demand since mid-2014. At the same time, increased U.S. production has brought about surplus supply. It is unlikely that oil prices are going to turn around soon. In fact, they appear poised to continue falling. This is important for all of Canada, not just oil producing provinces because the value of Canada’s dollar is driven primarily by the price of oil.

The catalyst of the current downturn was a drastic and continuing decline in the price of oil. Slowing growth in emerging markets, particularly in China, has been reducing global demand since mid-2014. At the same time, increased U.S. production has brought about surplus supply. It is unlikely that oil prices are going to turn around soon. In fact, they appear poised to continue falling. This is important for all of Canada, not just oil producing provinces because the value of Canada’s dollar is driven primarily by the price of oil.

According to Governor Poloz’s recent speech in Alberta, “Canada is able to handle swings in resource prices.” He spoke of how Canada has learned to ‘ride the commodity cycle.’ This seems to mean embracing the cheap loonie, reducing interest rates and banking on export-led growth. Do not expect the Loonie to gain much strength in the near term.

Time for Canadians to Buy Gold?

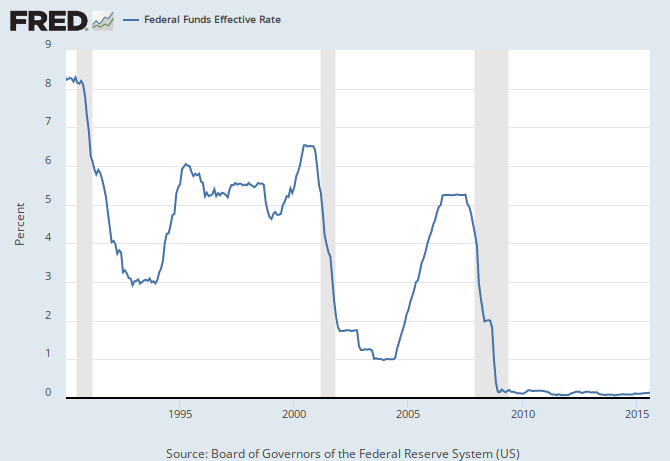

Where should Canadians put their money? The States are currently a safe haven for investors spooked by turbulent and unstable currency markets and slowing growth in emerging economies. The world is still adjusting to China’s surprise currency devaluation. Uncertainty abounds. Investing in the U.S. makes sense if you have faith in their economic footing and believe the Fed will follow through with a series of rate hikes in the near future and that higher rates will not have detrimental implications. It appears, the possibility is growing that very low rates might be here for a while. This is positive for gold. The highly anticipated rate hike will be the Fed’s first in over 6 years, a few more years might be marginal at this point.

Citing global factors, the Fed did not raise rates at their recent meeting but kept open the possibility of doing so later in the year. Basing their decision on global factors is prudent but leaves much uncertainty around the timing of future policy changes. Furthermore, higher interest rates will mean a stronger dollar, making it harder for the U.S. government to pay its enormous debt. South of the border, inflation is still close to nil, employment growth is questionable and other data is mixed. Anticipation of higher interest rates has, so far, kept gold from rallying but maybe investors should not hold their breath.

To keep rates near zero and climb out of the recession, the Fed used a lot of quantitative easing. They bought about $3 trillion worth of domestic debt, basically pumping cash into the economy. As a result, they have little power left to stimulate growth should that be necessary.

To keep rates near zero and climb out of the recession, the Fed used a lot of quantitative easing. They bought about $3 trillion worth of domestic debt, basically pumping cash into the economy. As a result, they have little power left to stimulate growth should that be necessary.

But Gold Appears to be on a Downward Trajectory?

It is nearly impossible to time markets. We do know that they eventually change direction. Investing in gold has been likened to betting on fear. It is therefore not surprising that following the attacks of September 11, 2001, the price of gold started to climb. The financial crisis, six years later that included the collapse of Lehman Brothers and the bail out of other banks and even entire countries, further spurred gold to new highs. Between 2001 and 2011, the price of gold went from below (USD) $300 to over $1900/ounce. The yellow metal then settled comfortably on a downward path. This is because economies started growing again, the U.S. dollar strengthened, stocks rallied and the global economy remained relatively stable. All this good news meant that gold now trades around its 2009 level.

However, gold trades in U.S. dollars and while gold prices have been dwindling, so has the value of the Loonie relative to those dollars. Canadians holding gold since 2011 would not be as worse off as U.S. gold investors. When the precious metal peaked in 2011, the Canadian and U.S. dollars were close to par. A Canadian who invested in gold back then would have lost just over 20% of their initial investment whereas a U.S. investor would have seen the value of their gold investment decline by over 40%.

Markets, especially markets for gold, are expecting U.S. interest rates to start rising and their dollar to strengthen even more. But what if the U.S. economy does not take flight as planned? Gold will certainly be poised for a rally. Alternatively, if the U.S. economy does ‘lift off’ and they successfully raise rates, you can sell your gold for big U.S. dollars, hedging your loss on the price of the metal. Remember, gold rallied and reached over USD $1,900 in 2011 while interest rates were nearly zero. The global economy may need time to consolidate following a period of rapid growth, stimulated by China’s undervalued currency. Gold becomes a valuable asset when global economic growth is murky and currencies unstable. The inherent value of gold may become particularly alluring if U.S. markets do not provide investors with the safe haven they need in these uncertain times.

Will Your Retirement Weather the Next Financial Crisis?

Gold has been used as an inflation hedge and a way to preserve wealth for millennia. We partnered with Silver Gold Bull, Canada's top-rated gold company (with over 280,000 five-star reviews), to offer Canadians a low-cost and tax-advantaged way to buy gold and silver through an RRSP/TFSA or another retirement plan.

Request More Info

Website: www.SilverGoldBull.ca

Speak to an Expert: (877) 707-4707

Copyright 2023 Gold RRSP - Helping Canadians invest in physical bullion for retirement